Tax Rates

PrintShop Mail Web is working with a sales tax mechanism (also called value-added tax or VAT). This mechanism covers tax rates for different countries and states/zipcodes/zipcode ranges. Tax is applied in the price calculation process at the end of the checkout process (shopping cart) based on the company or department.

The Tax Rates section found in the Settings side menu lets the administrator manage Tax Rate profiles. Tax Rates profiles can be assigned to:

-

Company

-

Department

-

Template

The tax rate assigned to a template has the highest priority. If no tax rate is specified for the template, the system will use the tax rate assigned to the company or department. If no tax rate is specified at company/department level the system will use the system default tax rate.

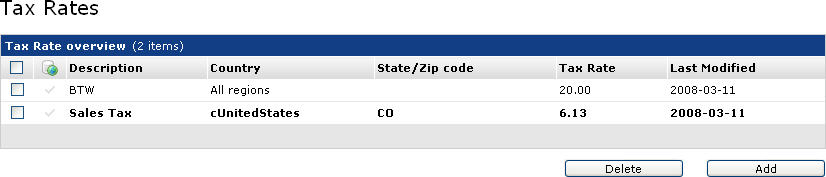

The Tax rates overview shows all available tax rates

To define a tax rate as the system default tax rate click the grey check mark in front of the tax rate description (name). The default tax rate has a black check mark in front of the tax rate description.