Setting Expense Markup Exceptions based on Net Amount

The Exceptions capability added to the Expense Markup Settings within Expense Invoicing settings under the Client Edit page gives the ability to choose to Apply Expense Markup on Net Amount and Gross Amount for the same Client but to different expense items.

- Net Amount; you have the option to Apply Tax on Expense Markup when invoicing (Client Tax Group will be used) or not.

- Gross Amount; you have the option to Apply Tax on Expense Markup when invoicing for exceptions (Client Tax Group will be used) or not.

This article covers how to set the Exceptions when applying Markups based on Net Amount.

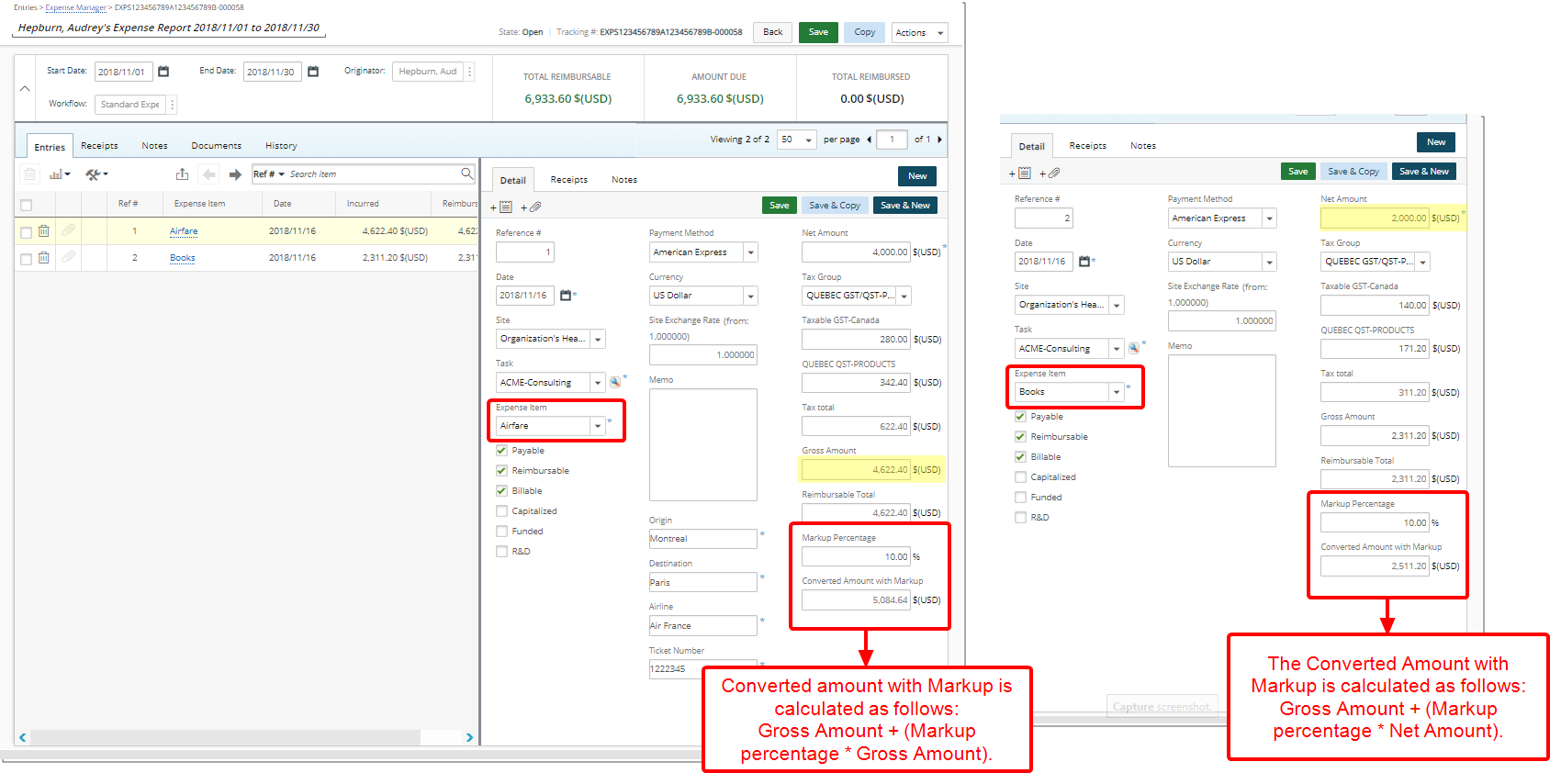

Example: One of Software Inc’s clients, Acme Corporation, should have its expense invoicing be set up such that the markup for the Travel Expense Item Airfare be calculated based on Gross Amount, while the Books Expense Item be based on Net Amount. The PSA Administrator, John Billings, can configure this requirement by selecting to Apply Expense Markup on Net Amount, and then selecting the Travel Item Airfare from the Exception List.

Therefore, when a project team member, who creates an Expense Report against a project for client Acme Corporation with these two items, the following will occur:

- Expense entry for Airfare will have its markup calculated based on Gross Amount.

- Expense entry for Books will have its markup calculated based on Net Amount.

Caution: Changes to markup calculations will be effective on new Expense Entries only.

- From the Icon Bar click Setup

.

. - From the Navigation Menu click Work to expand the corresponding menu.

- From the Work menu items, click Clients.

- From the Clients List page select the Client name to access the Client Edit page.

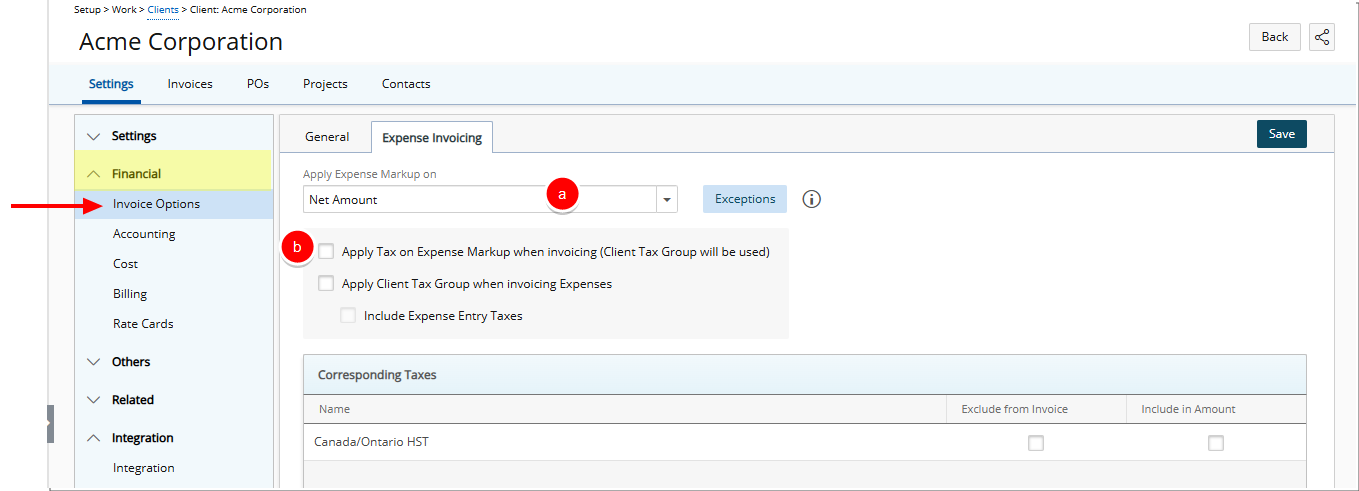

- From the Settings tab of the Client Edit page, expand the Financial navigation menu

- Click Invoice Options.

- From the Expense Invoicing sub-tab:

- Select Net Amount from the Apply Expense Markup on options.

- Select Apply Tax on Expense Markup when invoicing (Client Tax Group will be used) option.

Note: Upon selecting Net Amount the Apply Tax on Expense Markup when invoicing (Client Tax Group will be used) option is enabled. When selected The Client Tax Group will be used to apply the Tax on Expense Markup when an invoice is generated.

- Optionally select Apply Client Tax Group when invoicing Expenses option.

- If required Select to Include Expense Entry Taxes.

For more information on how to set Expense Markup Exceptions when applying Markups based on Gross Amount click here.

- Click Exceptions to access the Expense Markup Exceptions dialog box.

- If 'Net Amount' is selected on this page then items selected in Exceptions have markup applied on Gross Amount. (Gross Amount always includes Tips).

- If 'Net Amount + Tips' is selected on this page then items selected in Exceptions have markup applied on Gross Amount. (Gross Amount always includes Tips).

- If 'Gross amount' is selected on this page then items selected in Exceptions have markup applied on Net Amount + Tips. (As Gross Amount already includes Tips).

- Markup on Net Amount: Net Amount*markup percentage.

- Markup on Net Amount + Tips: (Net Amount + Tips)*Markup percentage.

- Markup on Gross Amount: (Gross Amount + Tips)*Markup percentage.

- Select the Items you wish to apply the Exception on from the available items on the left .

- Click the add

button to add them to the selected items list on the right.

button to add them to the selected items list on the right. - Click Back to return to the previous page.

Note: Upon clicking the arrow to add the items or remove items from the list, the page will refresh and a confirmation message will be displayed informing you of the addition or removal of items from the lists.

- Click Save to save your changes.

Caution: Changes to markup calculations will be effective on new Expense Entries only. Changes to Taxes can be reflected on non-posted Invoices by updating the Invoice.

- Note that:

- Expense entry for Airfare has its markup calculated based on Gross Amount.

- Expense entry for Books has its markup calculated based on Net Amount.