Assess the Competitive Landscape and Decision Criteria of your Opportunity: Introduction

Learning Objectives

After completing this topic, you’ll be able to:

Explain how to use the opportunity Assessment to help a revenue team to understand the competitive landscape of an opportunity from the perspectives of customers and competitors.

Recognize how decision criteria prepare the ground for the definition of competitive strategy.

In today’s hyper-competitive environment winning the deals that matter to you requires stepping back from the activities of the day to analyze the following with your team:

- How well you are positioned to win the deal?

- What is the path of action that increase your chances of winning the deal?

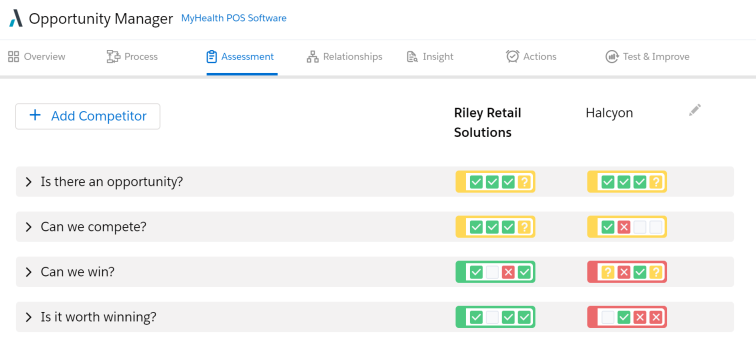

The opportunity Assessment represents a structured evidence-based approach that guides you and your team through the analysis of the opportunity to gain a deep understanding of the competitive landscape from the perspective of the customer, your competition and your company.

The opportunity Assessment guides you and your team through the questions of:

- Is there an opportunity?

- Can we compete?

- Can we win?

- Is it worth winning?

Using the questions, and the detail behind each question, you and your team will identify, what is known and not known regarding the customer, your company and your competition. This evidence-based insight will lead you and your team to the plan of action for each team member that is required to strengthen your competitive position in the opportunity.

Using the Assessment to assess the opportunity

Lynn Benfield is an account executive at Riley Retail Solutions, a company that specializes in advanced point-of-sale (POS) systems, including cash registers and card readers. They sell not just the hardware, but also the related software, training, and consultancy services.

Right now, one of Lynn's best prospects is MyHealth, a chain of health-care clinics that provide pharmacy services. MyHealth is expanding quickly and is running into new problems as they try to scale.

Lynn learned from Susan Linton, the COO at MyHealth, and an important supporter of hers, that MyHealth has an initiative to upgrade their POS software, and she believes that Riley Retail Solutions can offer them outstanding value as a supplier of this software.

Lynn Benfield and her team have spent time meeting the players at MyHealth that are engaged in the buying decision to understand their level of influence and role in the buying process. They have also used their meetings with each individual in MyHealth to learn what is important for them and what they care about. Lynn’s team paused to build their relationship map to visualize who matters, how their contacts think and what the status of their relationships is. They have used the insight map to structure their understanding of the goals, pressures, initiatives and obstacles that matter to the key players for the opportunity.

Now Lynn and her team want to conduct an assessment of their competitive position and determine what to do next in order to win the opportunity.

The Assessment screen provides a structure for analysis of the competitive position and facilitates an effective, evidence-based, and outcome-oriented collaboration for the team. We recommend that you conduct the assessment of the opportunity several times across the lifecycle of the opportunity; e.g. early, in mid-cycle and ahead of the ‘race to the finish line’.

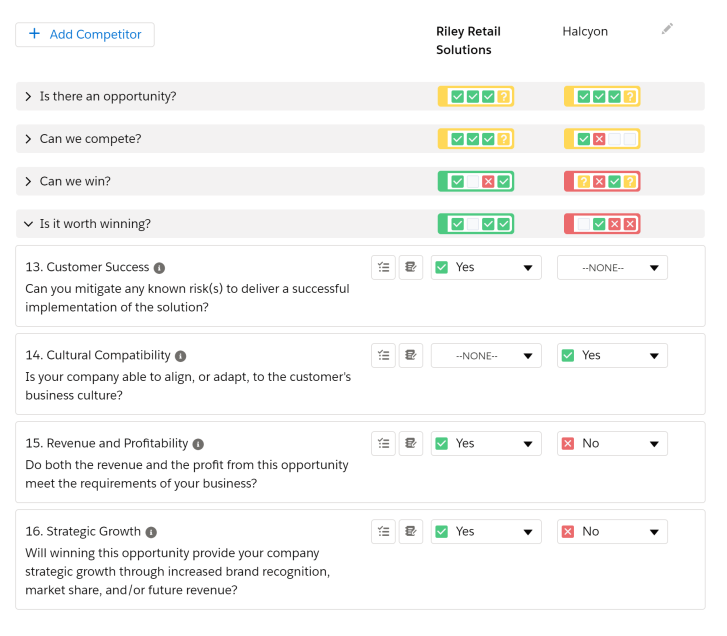

Lynn has ascertained that a competitor, Halcyon, is also pursuing the opportunity.

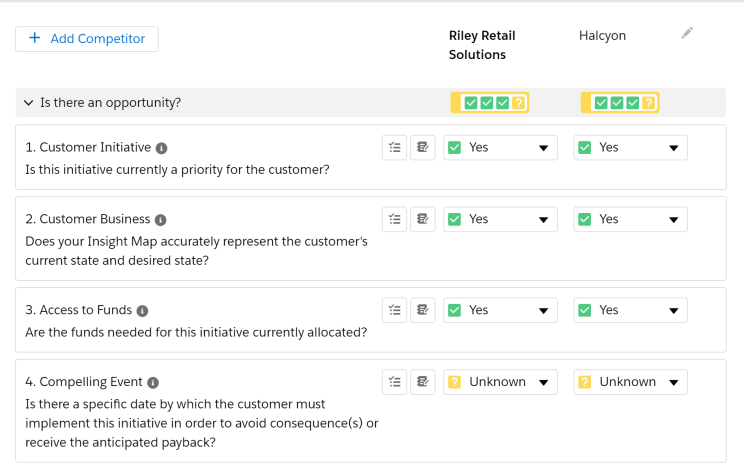

Question 1: Is there an Opportunity?

The items covered by the this first question are:

- Customer Initiative: the priority level of the initiative driving the opportunity.

- Customer Business: how accurately the insight map reflects the issues to be resolved by the initiative.

- Access to Funds: the availability of funding for the initiative.

- Compelling Event: the timing and impact of starting or not starting the initiative.

Lynn and her team conclude that Halcyon have a similar level of knowledge about the above items. Conspicuously, they note that while the initiative appears to be a priority for the customer, a Compelling Event that is driving the decision making is not yet known. In addition, the team agrees to adopt the best practice of capturing the evidence supporting their assessment in the text entry fields.

The team agrees to create an action to meet Susan Linton and Sophie Cooke to determine if there is a Compelling Event that is driving the initiative.

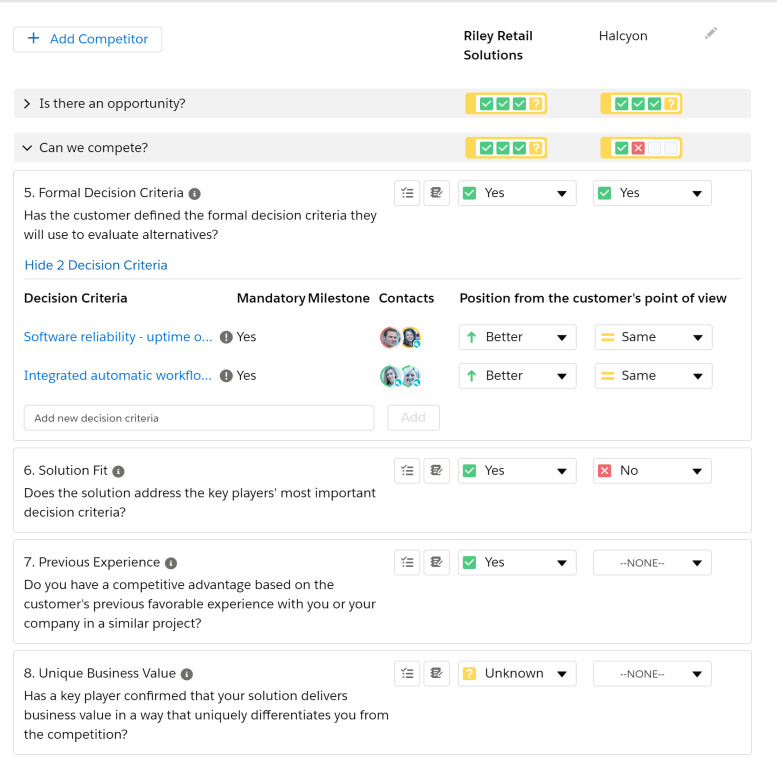

Question 2: Can We Compete?

The items covered by this question are:

- Formal Decision Criteria: the criteria the client will use to evaluate alternative solutions.

- Solution Fit: how well your solution and your competitor’s solution address the key players’ decision criteria.

- Previous Experience: your and your competitors’ competitive advantage based on the client’s previous experience with your company and the competitors.

- Unique Business Value: a key player’s confirmation that you or the competition deliver value in a unique manner.

One mandatory criterion is already by confirmed by Pete Morant of MyHealth, and was recorded by Lynn on the relationship map: ‘Software reliability – minimum uptime of 99.95%’. She adds the second formal criteria that has since been discovered by her team.

Lynn and the team can ascertain that their solution meets the two ‘must have’ Formal Decision Criteria. Nevertheless, they are concerned that have not yet had a key player articulate their Unique Business Value. They do view, however, their competitive position to be stronger than Halcyon.

Lynn creates another action to meet Susan Linton and determine Susan’s view of the unique value Riley Retail Solutions can deliver.

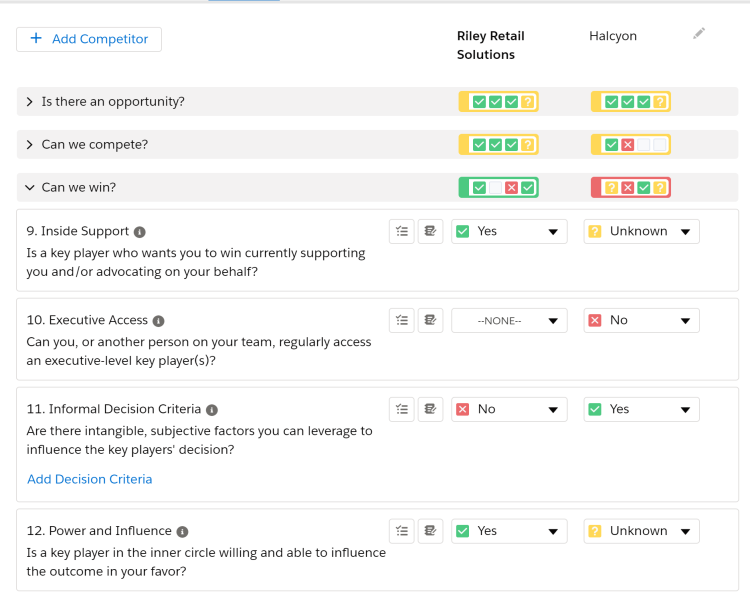

Question 3: Can we Win?

The items covered by this question are:

- Inside Support: a key player supporting and/or advocating on your behalf.

- Executive Access: regular access to executive level key players.

- Informal Decision Criteria: subjective, intangible factors influencing key players’ decisions.

- Power and Influence: a key player in the inner circle willing to influence the decision in your favor.

Lynn and the team consider their Inside Support and Power and Influence items to be significant assets. However, they feel exposed by their lack of Executive Access and knowledge of the Informal Decision Criteria. Also, the team’s sense of the level of competitive threat from Halcyon is heightened by the unknowns against the Inside Support and Power and Influence.

The team decides to mitigate the weakness in Informal Decision Criteria by investing in the level of trust between Lynn and Susan Linton. Lynn agrees to invite Susan to the next Customer Advisory Board meeting, giving Susan access to strategy level discussions with industry peers. The team also agrees to invest time in understanding the personal preferences related to the user interface and functionality of the evaluators who will test the competing solutions.

Again, Lynn creates the necessary actions.

Question 4: Is it Worth Winning?

The items covered by this question are:

- Customer Success: mitigating risks impacting a successful implementation of the solution.

- Cultural Compatibility: aligning/adapting to the customer’s business culture.

- Revenue and Profitability: meeting the revenue and profit requirements of your business.

- Strategic Growth: the opportunity represents strategic growth, e.g. brand recognition, future revenue, or market share.

Based on the findings of their company’s competitive intelligence research, Lynn and the team conclude that Halcyon may not want to pursue the opportunity aggressively due to the lack of Strategic Growth, Revenue and Profitability.

In summary, the team agrees to conduct further meetings with the customer to uncover the missing information they have identified to verify their assessment of the competitive landscape. The team also wants to focus on gaining clarity about items that they have set to 'Unknown' (e.g. Compelling Event) and 'None' (e.g. Executive Access).

At the next meeting the team will revisit the facts of their MyHealth opportunity using the Assessment and begin to develop a strategy to win the opportunity. The team recognizes the importance of having a deep understanding of the competitive position regarding the Compelling Event, Decision Criteria (formal and informal), Unique Business Value, Executive Access, and Power and Influence to conduct the strategy discussion. Lynn creates an action item for this meeting.

Are There Any Gaps in Your Knowledge?

Considering the insights from this early cycle assessment, Lynn and the team have used the structure of the assessment questions to guide their discussion. They have identified areas of strength, weakness and gaps in their knowledge. The team has agreed next actions to address these items and will reconvene to assess the opportunity again in the light of the facts gathered in the interim.

The Assessment provides a clear structure to assess an opportunity. Using the approach, and the application to capture and share the evidence gained, drives an effective and time efficient collaboration across the revenue team. Best practice is to conduct an assessment a number of times across the buying/selling cycle to ensure that the decision to pursue the opportunity represents a good investment of the time and effort of your team.