For each country and its states, provinces or regions, the Tax details can be defined with the appropriate tax rates and rules.

This article details how to create a Tax Rule.

- From the Icon Bar click Setup

.

. - From the Navigation Menu click Financial to expand the corresponding menu.

- From the menu click System.

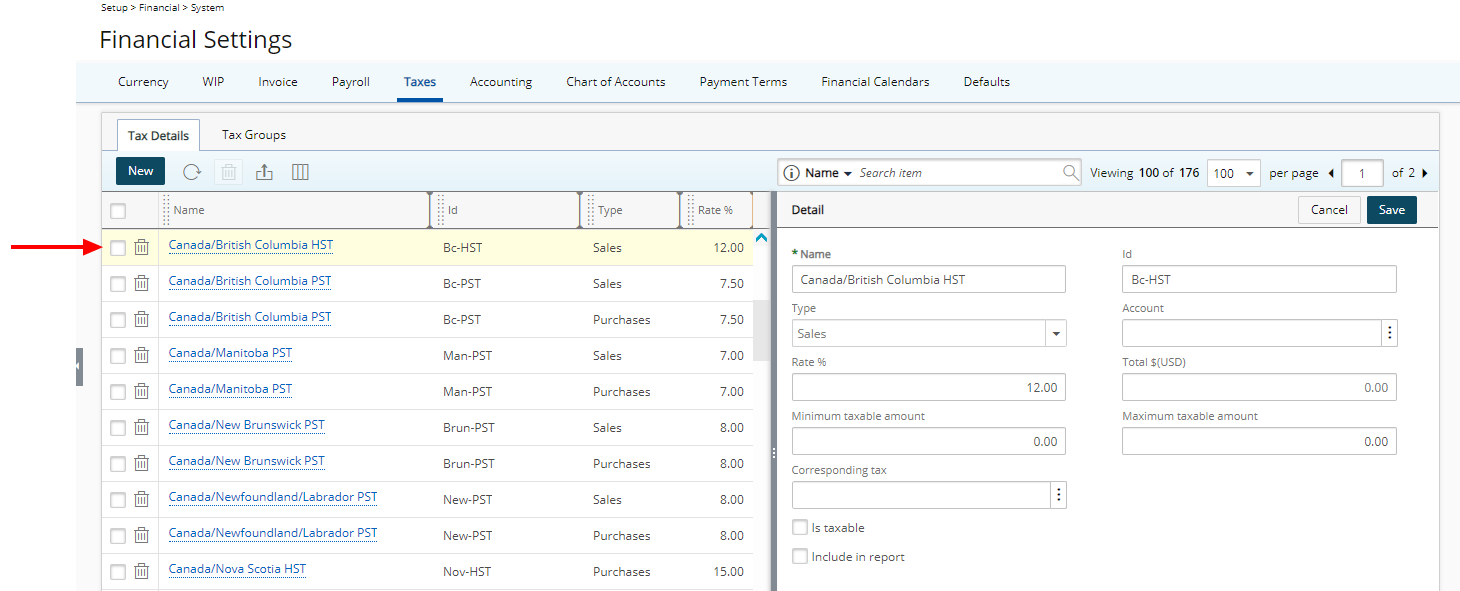

- Upon the Financial Settings page displaying navigate to the Taxes tab.

- Click the Tax Details sub-tab to view the list of available taxes

- Click the New.

- Note that the right pane will display the required fields to create the new tax by entering/selecting the following information:

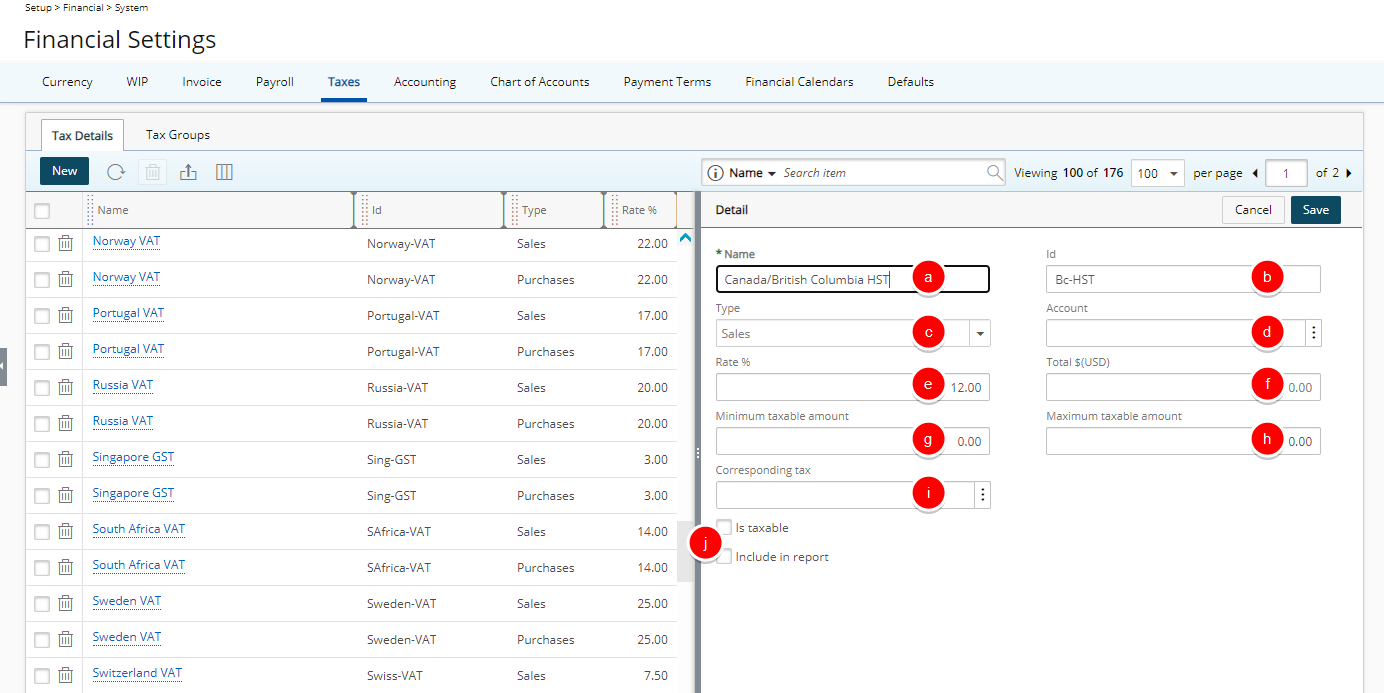

- Enter a Name for the tax.

- If there is an ID, enter it in the Id box.

- Select the type of tax from the Type list. The options are: Purchases and Sales.

- Click the browse button located against the Account box, to select an Account from the Account List dialog box.

- Enter the Rate %

- The Total box will automatically be filled depending on the Tax Group containing this Tax Detail when used in an Expense Entry.

- Enter the Minimum taxable amount

- Enter the Maximum taxable amount

- Click the browse button located against the Corresponding tax box, to select a Corresponding tax from the Tax Detail dialog box.

- Select if the tax rule Is taxable and if the tax rule should be Included in report, by selecting the corresponding boxes.

- Click Save to apply your changes.

- Upon saving, the newly created Tax rule will be listed on the left pane.