Each organization can have a different configuration and these fields can differ from one organization to another. Please consult your Administrator

Note: Inline search capability available for Site, Client, Project, Task, Expense Item, Payment Method and Currency is based on a "Contains in" logic. You may enter a partial name, which will automatically generate a list of matches that contain the characters as any part of the item respectfully.

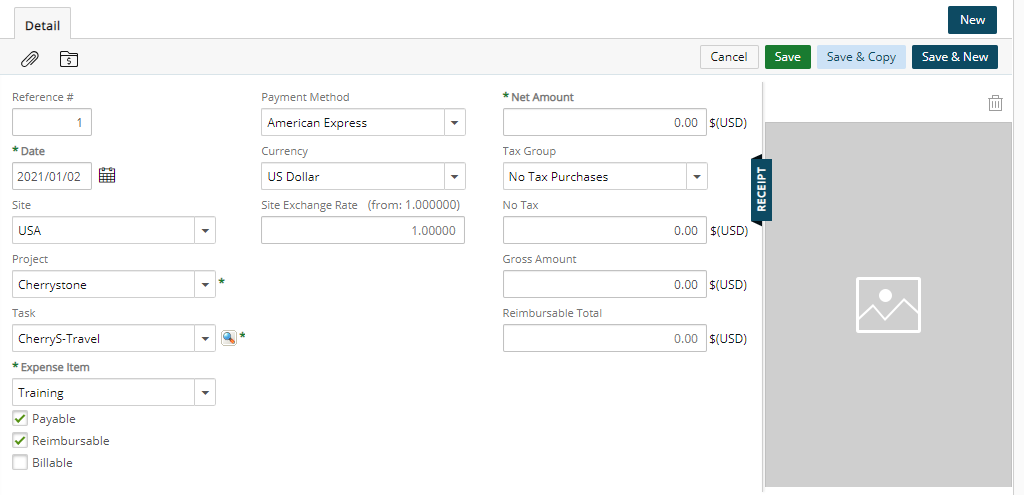

This article details the information that can be entered while creating an Expense Entry.

- Reference#: The Reference Number is a unique number that is assigned to a new Expense Entry. It can not be modified.

- Date: By default, the date is set to the current date. You may click the Date button to change the date when the expense was incurred.

- Site: Location where the expense incurred.

Note: The first 50 sites are displayed in alphabetical order. You can use the selection boxes’ scroll bar to load 50 more sites.

When updating the Site of an Expense Entry, the Expense Item remains unchanged, if it is associated with the newly selected Site. However, if the chosen Expense Item is not associated to the new Site or is suspended, your previously selected Expense Item will be cleared.

- Client: Client associated with the expense.

- Project: Project associated with the expense.

- Task: Task associated with the expense. Selected task is carried forward when creating a new expense entry.

Note: When selecting the values in the conventional manner, i.e. selecting a Client first filters the options available in the Project list, then choosing a Project filters the options available in the Task list. Moreover, these fields accommodate the back-fill capability wherein you can immediately select a Task, which then automatically selects the corresponding Project and Client, or immediately selecting a Project automatically selects the corresponding Client.

- Expense Item: Select an item from the Expense Item list to specify the type of expense being claimed; by default, Please Select is displayed in the Expense Item box. Where a category exists, it will be displayed in the Expense Item list in bold font with the items that fall under the given category being indented.

Note: Based on your Expense Item and Tax Group selection, additional entry boxes may display, either prefilled (editable) or blank and ready to accept an entry, some of which are mandatory.

- An Expense Item that falls under any of the following Expense Categories will generate additional mandatory entry boxes:

- Airfare

- Cash Advanced

- Entertainment

- Mileage

- An Expense Item that falls under any of the following Expense Categories will generate additional mandatory entry boxes:

- The Expense Entry Attributes are inherited from the Expense Item Attributes and its associated Task; therefore, the Expense Entry Attributes depend on which attributes, Payable, Reimbursable, Billable, Capitalized, Funded and R&D, are defined for the Expense Item.

- Payment Method: Select the method that will be used to pay the expense from the Payment Method list, options include Cash, Checking, Debit or credit cards.

Note: The Expense Payment Method with the lowest Sort order will be displayed as the default option within the Payment Method box when creating an Expense Entry. For further details refer to Setting up Expense Payment Methods.

- Currency: Select the currency that will be used to pay the expense from the Currency list.

- Site Exchange Rate: displays the exchange rate between the expense item currency and the user’s Master Site currency

- Memo: Enter additional information for the Expense Entry in the Memo box.

- Net Amount: Enter the total amount of the expense without the applicable taxes.

Note: When the Net Amount is entered, the system applies the appropriate taxes and automatically calculates the total amount of the expense item with the applicable taxes in the Gross Amount box. The Total Tax box (read-only) also displays the sum of the tax details.

- Gross Amount: Enter the total amount of the expense with the applicable taxes.

Note: When the Gross Amount is entered, the system automatically calculates the total amount of the expense item without the applicable taxes in the Net Amount box.

- Reimbursable Total: Displays the total reimbursable expense amount in the user’s Master Site currency (converted using the site exchange rate)