The Prevent Revenue Accrual When Entry Amounts Are Not Fully Associated to POs option, found within the POs tab on the Client Edit page, plays a crucial role in managing your financials. When this option is selected, it prevents an invoice from being transitioned to a state marked as Recognize Revenue unless all entry amounts are fully associated with corresponding POs. This safeguard ensures that revenue is only recognized for fully approved and allocated amounts, maintaining the integrity of your financial reporting.

This article explains how to enable this setting and effectively prevent revenue accrual when entry amounts are not fully tied to POs for a client. By understanding and using this feature, you can ensure more accurate revenue recognition and avoid potential discrepancies in your financial records.

- From the Icon Bar click Setup

.

. - From the Navigation Menu click Work to expand the corresponding menu.

- From the Work menu items, click Clients.

- From the Clients List page select the Client name to access the Client Edit page.

- Upon the Client Edit page displaying, click the POs tab.

- Select the Prevent revenue accrual when entry amounts are not fully associated to POs option.

Impact of your selection

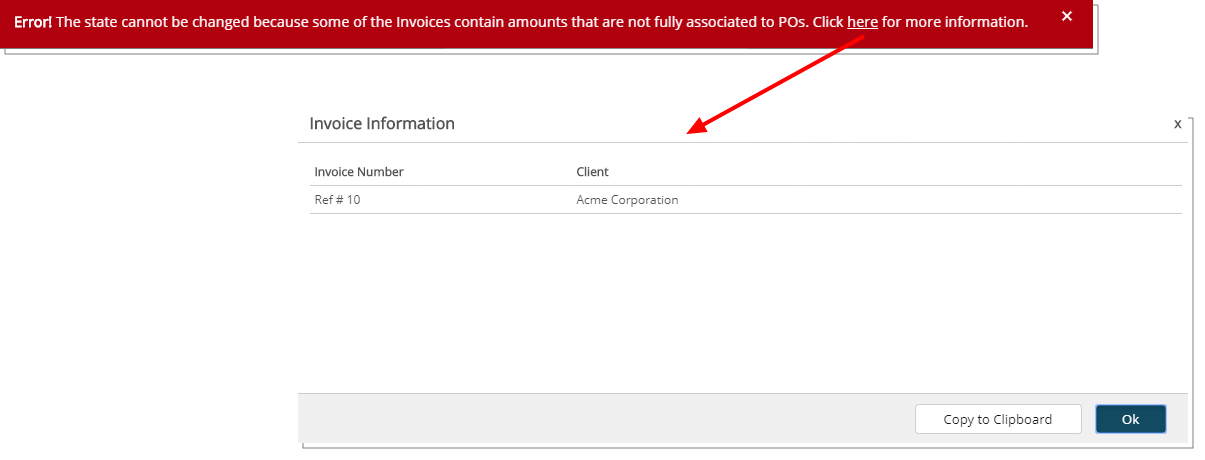

An error message is generated upon attempting to change the State of an Invoice, with the Apply Revenue Recognition Policy option selected, contained within an Invoice Batch with amounts that are not associated to POs.

- The error message bar informs the user that: "The State cannot be changed because some of the Invoices contain amounts that are not fully associated to POs. Click here for more information."

- Clicking on the link, within the error message bar, opens a modal widow, allowing users to copy the relevant Invoice Information to their clipboard for further investigation.